Introduction

The Corporate Transparency Act (CTA), signed into law in January 2021, represents a significant shift in the way businesses, including common interest community (CIC) boards, operate in the United States. This landmark legislation aims to enhance corporate transparency and combat financial crimes by requiring certain entities to disclose their beneficial ownership information to the federal government. While the CTA primarily targets larger corporations, its potential impact on CIC boards is worth examining, as these community organizations are essential in maintaining and governing residential communities across the nation. It is essential that your CIC board understands these requirements and takes appropriate steps to ensure compliance.

Understanding the Corporate Transparency Act

The Corporate Transparency Act is designed to address issues related to money laundering, tax evasion, fraud, and other financial crimes. The primary mechanism for achieving these goals is the establishment of a beneficial ownership reporting requirement. Under this provision, certain businesses, including corporations, limited liability companies (LLCs), and other similar entities, must disclose detailed information about their beneficial owners to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN).

A “beneficial owner,” as defined by the CTA, is an individual who directly or indirectly exercises significant control over an entity or owns at least 25% of its ownership interests. This definition includes officers and members of CIC boards, unless the CIC falls within a designated exception.

When Does It Take Effect?

The CTA became effective on January 1, 2024.

Companies that were created or registered to do business in the United States before January 1, 2024 must file by January 1, 2025.

Newly created or registered companies (since January 1, 2024) have 90 calendar days to file after receiving actual or public notice that their company’s creation or registration is effective.

More information related to the actual filing can be accessed on FinCEN’s Beneficial Ownership Information Page. Access the form by going to FinCEN’s BOI E-Filing Website.

The Impact on Common Interest Community Boards

Common Interest Community (CIC) boards typically govern condominium associations, homeowners’ associations, and other residential community organizations. These boards play a crucial role in managing community resources, maintaining common areas, and enforcing community rules and regulations. While they are not traditional corporations or businesses, they often do incorporate as nonprofit or for-profit entities, such as LLCs, to manage their finances and legal responsibilities. This incorporation/registration with the Colorado Secretary of State subjects them to the CTA unless they fall within certain designated exceptions.

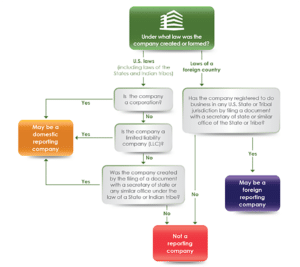

Here is a helpful flowchart* to aid in making this determination:

Actions for Your CIC:

- Assessment: Begin by assessing your CIC’s legal structure. If your CIC meets the criteria outlined in the CTA, you may need to report beneficial ownership information.

- Legal Counsel: Seek legal advice from professionals who can help guide you through the compliance process. Note that there are significant civil and criminal consequences for noncompliance with the CTA, so it is better to be safe than sorry.

- Data Collection: If required, start collecting the necessary information about beneficial owners within your CIC.

- Compliance Plan: CIC boards are most likely subject to the reporting requirements of the CTA unless they fall within specific exceptions. Develop a compliance plan that outlines how your CIC will meet reporting requirements. Communicate early and often to ensure that your board and relevant personnel are aware of their roles in this process. Compliance with this provision may require additional administrative efforts and updates when information changes.

- Privacy Measures: Some CIC board members may have concerns about the privacy implications of disclosing beneficial ownership information. Be mindful of privacy concerns when handling personal identifying information administratively. The CTA includes safeguards to protect sensitive information from public disclosure. However, it’s crucial to establish protocols to secure and manage the collected data responsibly.

- Stay Informed: Keep abreast of updates and guidance from federal authorities regarding CTA compliance. Regulations and reporting requirements may evolve or become clarified over time, and it’s essential to stay informed about any changes.

- FinCEn Chat: FinCEN has a helpful chat function that may help answer simpler questions or guide you to additional resources as they become available.

Impacts for your CIC:

The CTA’s impact on CIC boards may be indirect but significant. Here are some positive ways it may affect them:

- Increased Accountability: Although CIC boards are not the primary targets of the CTA, their legal structures may still require them to disclose beneficial ownership information within specific timelines. This increased transparency could foster greater accountability among board members and reduce the risk of financial improprieties within the community.

- Enhanced Due Diligence: As part of the due diligence process, potential buyers, or investors in CICs may request information about the entity’s compliance with the CTA. Boards that can demonstrate adherence to these requirements may enhance their reputation and attractiveness to prospective homeowners.

Conclusion

The Corporate Transparency Act represents a groundbreaking shift towards greater transparency in corporate ownership across the United States. While the primary focus is on larger corporations and entities, common interest community (CIC) boards should be aware of the CTA’s potential implications.

Embracing transparency and complying with the CTA’s reporting requirements can help CIC boards build trust within their communities, foster accountability, and contribute to the broader national effort to combat financial crimes. As the CTA’s implementation progresses, CIC boards should educate themselves, stay informed with updates, and seek legal counsel with specific questions to ensure compliance with this significant regulatory change.

*Figure 1. Flowchart. Adapted from Beneficial Ownership Information Reporting Frequently Asked Questions released by FinCEN, 2020 (updated 2024) – https://www.fincen.gov/sites/default/files/shared/BOI_FAQs_QA_01.12.2024.pdf